Physicians for a Smoke-Free Canada.

Coalition Québécoise pour le contrôle du tabac

Health groups call on finance ministers to strengthen tobacco tax policies.

(Ottawa and Montreal). Health groups today called on finance and revenue ministers to respond to tobacco manufacturers’ recent price hikes and to protect public health by curbing the profits of multinational tobacco companies. Increased taxes are a better way to reduce smoking than increased profits.

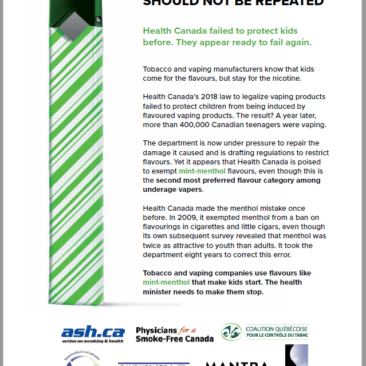

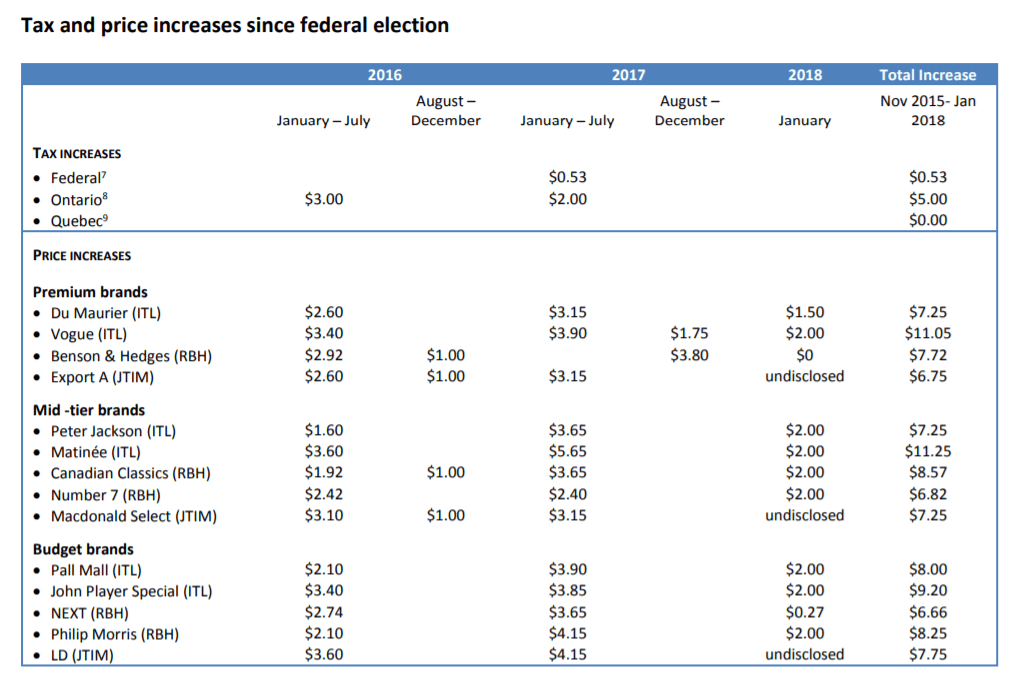

“This week tobacco manufacturers increased their cigarette prices for the eighth time since the last federal election,” explained Neil Collishaw, research director for Physicians for a Smoke-Free Canada. He acknowledged that increased cigarette prices normally benefit public health by discouraging tobacco use, but pointed out that manufacturers are able to use frequent small price changes to reduce the impact on smoking rates.

“By failing to raise tobacco taxes, finance ministers have given the industry the pricing room needed to increase its profits in Canada by more than one billion a year, while at the same time circumventing the health benefits that an across-the-board tax increase would have provided,” said Mr. Collishaw.

Physicians for a Smoke-Free Canada has observed that since the last federal election, the average wholesale price of cigarettes has increased by $7 to $11. Over the same period, federal tobacco taxes have increased by only $0.53. Health Canada recently confirmed that tobacco manufacturers’ revenues had increased by $1 billion per year since 2015.[1]

“The situation is similar with respect to Quebec tobacco tax policy,” said Flory Doucas, co-director of the Quebec Coalition for Tobacco Control. “Because neither federal nor provincial tobacco taxes have been meaningfully increased since 2014, tobacco companies have been able to increase their profits while forcing governments and communities to shoulder the staggering economic burden that results from smoking.” In a report commissioned by Health Canada, the Conference Board of Canada recently estimated that tobacco use in Canada results in 45,000 deaths and $16 billion in direct and indirect economic costs each year.[2]

“The numbers speak for themselves,” said Neil Collishaw. “By keeping taxes low, governments allow tobacco industry shareholders to grow richer at the expense of the health and economic well-being of Canadian communities.”

“These price increases further expose the alliance between retail associations and tobacco companies,” Flory Doucas observed. “Although retailer spokespeople routinely predict that increases to tobacco tax will result in higher contraband sales, they say nothing when manufacturers increase prices by far greater amounts.” Last year an internal document from British American Tobacco detailed how retailer associations were engaged to raise fears of contraband as a way of discouraging governments from raising taxes or imposing new regulations.[3]

Tax avoidance by tobacco multinationals

“Sadly, excise taxes are not the only area where the tobacco industry has been able to increase its profits as a result of federal tax policy,” said Neil Collishaw. “In addition to striking down the Tobacco Manufacturers’ Surtax, the Finance Minister has failed to close the loopholes that have allowed tobacco companies to avoid $40 million or more in annual income taxes.”

The last federal budget eliminated the ‘health promotion surtax’ on tobacco profits4 that was established in 1994. This surtax became less effective after tobacco companies found ways to reduce (or eliminate) their income tax responsibilities in Canada, but was nonetheless an important step to applying the polluter pay principle to public health. Court records have revealed that JTI-Macdonald and Imperial Tobacco use off-shore investments and other international financial tricks avoid tens of millions in income taxes otherwise payable in Canada.[5][6]

“Three key reforms are needed to align federal tax and health policies,” said Neil Collishaw. “Firstly, governments should immediately start recouping the industry’s recent price increases by imposing an equivalent tax increase, likely in the order of two consecutive increases of $5 per carton. Secondly, the federal government should restore the polluter pay principle to tobacco and impose a regulatory charge equivalent to the tobacco control budgets of Canadian governments and communities, likely in the order of $200 million per year. Thirdly, the federal government should close the income tax loopholes that allow foreign multinational tobacco companies to avoid paying income tax in Canada.

References

- Robert Nugent and Gabrielle Tremblay. Wholesale cigarette prices in Canada: Industry revenue vs. Excise tax. Health Canada. February 2016.

http://www.smoke-free.ca/eng_home/2017/HC%20poster_price-Eng.pdf - Conference Board of Canada. Press release. Smoking Costs Canadian Economy More Than $16 Billion in 2012. October 16, 2017.

http://www.conferenceboard.ca/press/newsrelease/2017/10/16/smoking-costs-canadian-economy-morethan-$16-billion-in-2012?AspxAutoDetectCookieSupport=1 - Tom Blackwell. Leaked Big Tobacco document suggests it used convenience-store, anti-contraband groups as lobbyists. National Post. October 25, 2016.

- Minister of Finance. Budget 2017. Tax Measures: Supplementary Information. March 2017. https://www.budget.gc.ca/2017/docs/tm-mf/si-rs-en.html

- “JTIM has benefited from tax savings which initially stood in the $40 million range per year and today continues to exceed $30 million per year.” Quebec Court of Appeal. 500-09-025386-152. JTI-Macdonald v. Conseil Québécois sur le tabac et la santé, jean-Yves Blais, Cécilia Létourneau. Factum of the Appellant JTI-Macdonald Corporation, December 2015, para 384 http://www.smoke-free.ca/Eyeonthetrial/Appeal-Memorandum-JTI.pdf

- “Reductions of taxes otherwise payable [in 2005 by Imperial Tobacco] $11,953,075.” Callard, Cynthia. A footnote from the federal Tax Court. Eye on the Trials Blog. August 7, 2015. http://tobaccotrial.blogspot.ca/2015/08/a-footnote-from-federal-tax-court.html

- Canada Revenue Agency. Rates of Excise Duty. http://www.cra-arc.gc.ca/E/pub/em/edm1-5-1/edm1-5-1-e.html#_Toc396464390

- Government of Ontario. Tobacco tax rates. https://www.ontario.ca/data/tobacco-tax-rates

- Revenue Quebec. Tobacco tax rate table. http://www.revenuquebec.ca/documents/en/formulaires/ta/TA-1-V(2014-06).pdf