E-cigarette taxes: A global snapshot

Earlier this month, we reported on taxes on cigarettes in Canada, and also on heat-not-burn tobacco sticks.* This post reviews Canadian tax measures on e-cigarettes (vaping products), and compares with those in other jurisdictions.

Vaping taxes in Canada:

Currently, the federal government does not impose taxes on e-cigarettes, other than the GST at the rate imposed on all consumer goods.

Three Canadian provinces have indicated that they intend to set tax rates for vaping products which are higher than for other goods. One of these taxes is already in place:

- British Columbia applies HST at a rate of 20% to vaping devices and liquids since January 1, 2020.

- Alberta announced in October 2019 that it would tax vaping products, and set the tax rate at 20% in its February 2020 budget, although it did not specify an implementation date.

- Nova Scotia announced in its February 2020 budget that it would impose a specific tax of $0.50 per millilitre for liquids, and a 20% tax on devices, effective September 15, 2020.

Vaping taxes in the United States:

23 U.S states apply taxes to electronic cigarette devices or the nicotine liquids that are used with them, as do a small number of municipalities. A number of approaches have been adopted. Some impose a tax on the value of the product (ad valorem tax), ranging from 15% (Illinois) to 95% (Minnesota and Washington DC). Others impose a tax on the amount of vaping liquid sold (specific tax), ranging from $0.05 per ml to $1.20 per ml (Chicago). Some jurisdictions blend both tax approaches. A table showing tax rates is available here.

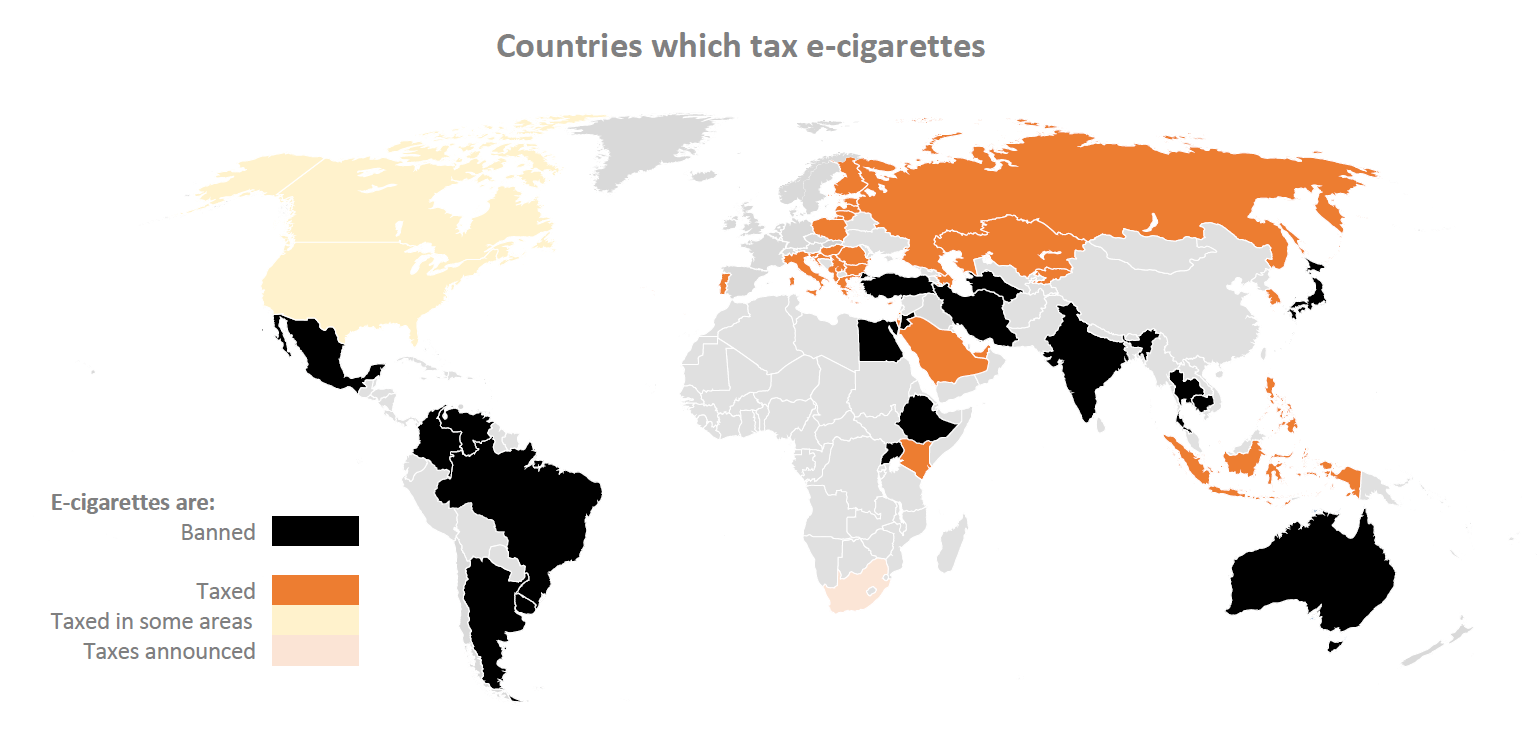

Vaping taxes in other countries:

More than two dozen countries impose taxes on e-cigarettes, although in some cases the tax rate is set low or even at zero. A list of countries, and the rates charged, is available here.

Some innovative approaches are among these examples. Two countries (Croatia and Kazakhstan) apply a zero rate tax. This does not produce any revenues, but it does provide government with information on the market size and growth. South Korea applies four types of taxes on e-cigarette products, including a tax directed to support health promotion activities and to address the costs of disposing the waste from the products.

The rationale for e-cigarette taxes:

A year has passed since the World Bank published its review on E-cigarettes: Use and Taxation, in which it reviewed the evidence and noted the “challenging” environment for e-cigarette tax policy. Since this review, additional research has also become available:

- a U.S. study of retail sales finding that a 10% increase in vaping taxes was associated with a 26% reduction in sales of vaping devices and an 11% increase in tobacco sales. (Whether any cross-substitution was among former smokers or dual users or young people was not explored in this study).

- a 2020 review by the California Legislative Analyst’s office of a proposed new tax, identifying key policy questions for legislatures and suggesting that differential taxes be charged for products associated with youth use.

- a 2019 study of the impact of Minnesota’s tax, finding that its higher e-cigarette was associated with fewer smokers quitting between 2012 and 2015 than in areas without taxes. (The impact on young people was not evaluated).

- a 2020 study comparing the impact of regulatory (and tax) measures in various U.S. states on e-cigarette initiation and tobacco smoking on individuals 18-24, 25-24 and older. (Taxes were associated with an impact, as were other measures).

- a(nother) 2020 study comparing e-cigarette regulatons and tax measures across U.S. states on e-cigarette use among individuals over 18, finding taxes was associatesd with reduced use among those 18-24.

Resources and additional reading:

- The Public Health Law Center, which also provides links to enabling legislation.

- European Commission. Review of taxation in EU. 2019

- The Vapour Products Tax data centre.

- PSC Fact Sheet. 2020

- World Bank. E-cigarettes: Use and Taxation: 2019

- Louisiana. Office of Public Health. Health Impacts and Taxation of Electronic Cigarettes. 2018

- California. Budget 2020-21. Taxation of E-cigarettes. February 2020.

- C. Cotti et al. The effects of e-cigarette taxes on e-cigarette prices and tobacco product sales: Evidence from retail panel data. 2020.

- Saffer, H et al. E-cigarettes and adult smoking: evidence from Minnesota. 2019.

- J. Jun et al. Do state regulations on e-cigarettes have impacts on e-cigarette prevalence? 2020.

- Y. Du et al. Association of Electronic Cigarette Regulations With Electronic Cigarette Use Among Adults in the United States. 2020

———————————————————

* The information on heat-not-burn taxes has been corrected. British Columbia has delayed changing its tax on these products as a result of COVID-19. The legislation authorizing those changes was not passed by the legislature at the time the tax was due to come into effect (April 1).