An update on tobacco sales and tax revenues in Canada

This post provides updated information on cigarette sales and tobacco taxes in Canada. Links to Fact sheets with the data reflected in the figures below are provided at the bottom of the post.

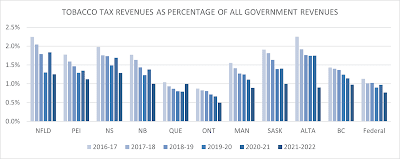

1) Total tobacco tax revenues in Canada continue to fall – and more quickly than predicted by tax officials.

Overall, tobacco tax revenues across Canada fell by 6% in 2021-2022 compared with the previous fiscal year.

All of the provinces experienced a decline in tobacco tax revenues, from a provincial total of $4.46 billion in 2020-21 to $3.95 billion in  2021-2022. The drop was greatest in Newfoundland (-21%), New Brunswick (-20%), Alberta (-18%), and Ontario (-16%). It was smallest in British Columbia (-0.4%), Quebec (-5%) and Prince Edward island (-7%).

2021-2022. The drop was greatest in Newfoundland (-21%), New Brunswick (-20%), Alberta (-18%), and Ontario (-16%). It was smallest in British Columbia (-0.4%), Quebec (-5%) and Prince Edward island (-7%).

This was offset by a modest increase in federal tobacco tax revenues (3%), resulting from a $4 per carton tax increase included in the 2021 budget. At that time, Finance Canada predicted that this would increase revenues by $415 million — but the real increase was just over one-quarter of that prediction.

Almost all (94%) of the federal tobacco tax is collected on manufactured cigarettes, with taxes on cigars and loose tobacco totalling less than $203 million. Provincial governments do not provide detail on revenues from different types of tobacco.

2 ) Industry revenues from cigarettes continue to climb, even though sales continue to fall.

) Industry revenues from cigarettes continue to climb, even though sales continue to fall.

Tobacco manufacturers are required to report to Health Canada the number cigarettes they sell, and also to report on their wholesale revenues (including federal taxes) from these sales. This data is released by Health Canada in an aggregate form for each calendar year.

From this data a comparison with the revenues to manufacturers and the federal government from cigarette sales during the calendar year can be made. Since 2014, industry revenue has increased by $1.5 billion a year (54%), while federal tax revenues on the same sales have fallen by $190 million (-6%).

3) The average Canadian smoker provided governments with $1,862 in tobacco-specific taxes in 2021

In 2022, the federal government applied a tax of $29.79 to each carton of cigarettes. Provincial excise taxes ranged from $29.80 per carton (Quebec) to $65.00 (British Columbia and Newfoundland). The Northwest Territories applies the highest tax ($68.80 per carton). Almost two-thirds (64%) of Canada’s smokers live in Quebec and Ontario, where where tobacco taxes are lowest.

In 2021-2022, these taxes resulted in an average of $1,862 in government revenues from tobacco sales to each of Canada’s 3.8 million smokers. The federal government reported $830 in tobacco tax revenue per smoker and provincial governments reported revenues between $627 and $1,862 per smoker. This works out to a total of about $5.10 in tobacco tax per smoker per day.

4) Fifteen cigarettes were reported sold each day for each Canadian smoker in 2021

5) Tobacco taxes represent less than 1 cent for every dollar of Canadian tax revenue.

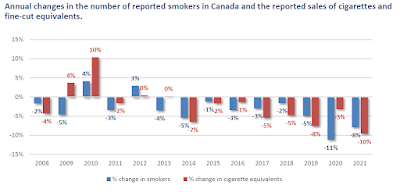

6) Shifts in reported cigarette sales and tax revenues help assess estimates of contraband and smoking prevalence

▪ changing patterns of nicotine use (e.g. shifting to or away from e-cigarettes)

▪ variance in the estimates of smoking behaviours

▪ changes in the proportion of the market which is illicit/unreported.

▪ incomplete reporting by manufacturers

Between 2020 and 2021, for example, the change in the number of cigarettes sold and the change in the number of smokers was roughly comparable (-10% and -8%), as shown in the figure below. During the previous year, at the beginning of the COVID pandemic, there was a greater drop in the estimated number of smokers than in reported cigarette sales (-11% vs -3%). This suggests that factors such as the COVID-related changes to survey methods or the decreased availability of contraband may contribute to this discrepancy.

Over the past year there were notable discrepancies in the patterns of cigarette sales and reported smokers in some provinces. In Manitoba, for example, the estimate of the number of smokers fell by a quarter (-28%), while cigarette sales grew by one-tenth (8%). In British Columbia, the number of smokes fell slightly (-3%) in comparison with a large drop in cigarette sales (-12%). (See Fact Sheet for provincial figures).

Downloadable Fact Sheets

- Tax revenues from tobacco sales, 1990 to 2022

- Tobacco tax revenues per smoker, Canada 2011 to 2022

- Tobacco tax revenues as a percentage of government revenues

- Provincial cigarette and fine-cut sales per smoker

- Manufacturers’ and federal tax revenues from cigarette sales.